Why Your Home Insurance Premiums Are Rising

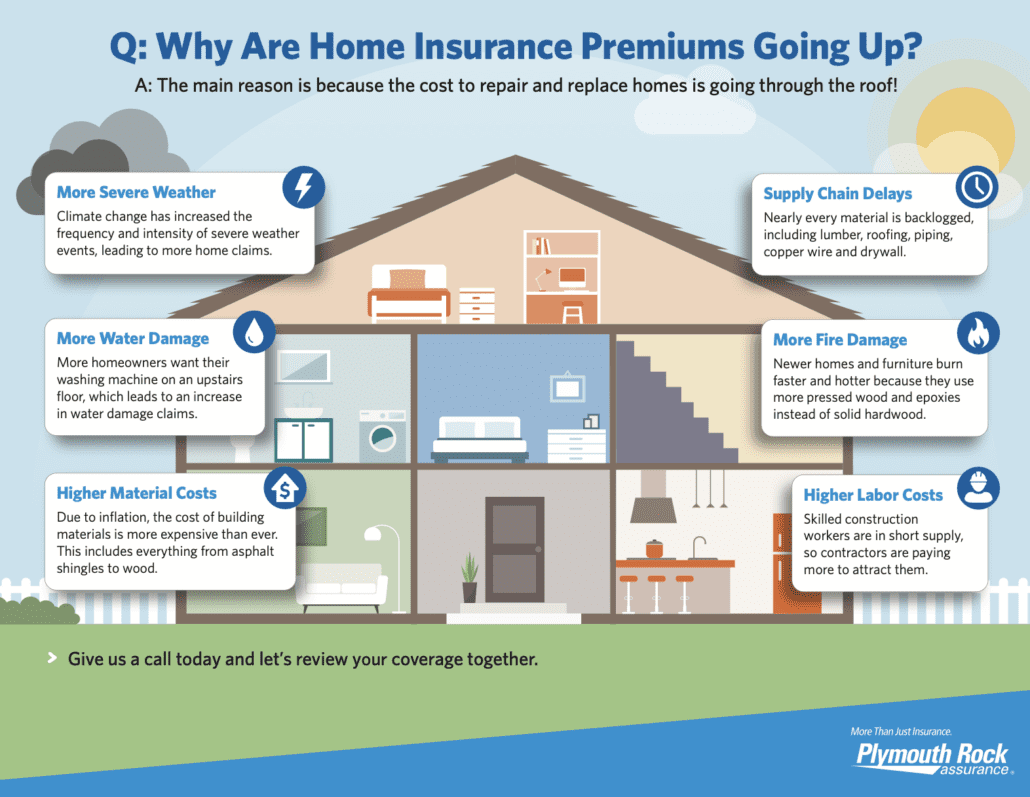

Our friends from Plymouth Rock Assurance recently posted an article on why home insurance prices are going up. We found it very helpful and decided to post similar article here.

Homeownership is a dream for many, offering a place of stability and comfort. But with that dream comes responsibility, and one important aspect is having proper home insurance. Unfortunately, many homeowners are facing a harsh reality, especially in the last years – rising home insurance premiums. This can feel like a financial burden, leaving you wondering why exactly costs are climbing.

The Storm Within the System: Climate Change and Its Impact

Climate change is no longer a distant threat; it’s a reality impacting our daily lives, and home insurance is no exception. Massachusetts is being affected among the rest.More severe weather events, like hurricanes, extreme temperature, long period of drought or floods are becoming increasingly frequent and intense. This translates to a surge in home insurance claims, as these events cause significant damage to properties. Insurance companies, facing a rise in payouts, are forced to adjust their premiums to maintain solvency and ensure they can continue to support policyholders in the face of these growing risks.

Supply Chain Blues: Delays and Disruptions

The global pandemic has caused significant disruptions in supply chains, impacting the availability and cost of building materials. Lumber, roofing, piping, copper wire, and drywall are just a few examples of materials experiencing backlogs. Remember those Texas cold spell that resulted in many consequences, such as glue shortage? These delays not only extend repair times but also drive up the cost of repairs. When repairs become more expensive, it naturally affects how much insurance companies need to pay out in claims. To account for this, they may adjust premiums to reflect the increased cost of rebuilding or repairing a home in the event of a covered loss.

A Rising Tide Lifts All Boats: Inflation and Material Costs

Inflation is another culprit behind rising home insurance premiums. The cost of virtually everything, including building materials, is on the rise. From asphalt shingles to wood, the materials needed to rebuild or repair a home have become more expensive. This means that even if a severe weather event doesn’t strike, the cost of repairing a standard claim has simply increased. Insurance companies need to factor in these rising costs when calculating premiums to ensure they have enough capital to cover potential claims.

Water Woes: Increased Risk of Water Damage

Modern home design trends may contribute to a rise in water damage claims. The desire for increased living space can lead to features like washing machines on upper floors. just think about Seaport in Boston, build on the sea level and already experiencing floods. Decision to build on the water maybe nice, but these placements introduce a higher risk of water damage if a leak occurs. Insurance companies see this trend and may adjust premiums to reflect the increased risk associated with specific home features or layouts.

Fire Gone Faster: The Burning Issue of Modern Materials

Unfortunately, even new homes are not immune to the threat of fire damage. Modern construction often utilizes materials like pressed wood and epoxies instead of solid hardwood. While lighter and potentially more affordable, these materials tend to burn faster and hotter in a fire. This can lead to more extensive damage, requiring a higher payout from the insurance company. As a result, premiums may be adjusted to reflect the increased risk associated with the use of these materials in newer homes.

Labor Shortage: The Cost of Skilled Workers

The skilled labor shortage in the construction industry is another factor impacting home insurance premiums. With fewer qualified workers available to handle repairs, contractors are forced to pay a premium to attract and retain talent. This rise in labor costs translates into higher overall repair costs, which insurance companies must account for when setting premiums.

Taking Shelter from the Storm: Strategies for Managing Rising Premiums

While the factors driving up home insurance premiums may seem daunting, there are steps you can take to manage the situation:

- Shop Around: Don’t settle for the first quote you receive. Get quotes from multiple insurance companies to compare rates and coverage options. We can help you to get quote from different insurance underwriters, ensuring you will be happy with your policy and can shop around in one place.

- Raise Your Deductible: Increasing your deductible, the amount you pay out of pocket before insurance kicks in, can lower your premium. However, ensure you can comfortably afford the higher deductible in case of a claim.

- Bundle Your Policies: Bundling your home insurance with other insurance policies, like car insurance, can often lead to discounts.

- Improve Your Home’s Resilience: Consider mitigation strategies to reduce your home’s risk of certain types of damage. This could include installing storm shutters, a new roof, or upgrading your electrical wiring.

- Maintain Your Home: Regular maintenance, like cleaning gutters and inspecting your roof, can help prevent damage and potential claims.

Weathering the Storm Together

Understanding the reasons behind rising home insurance premiums can empower you to make informed decisions. While the situation may seem challenging, remember that home insurance remains essential for protecting your investment. By implementing some of the strategies mentioned above, you can minimize the financial impact of rising premiums while ensuring your home remains properly protected.

Having proper insurance and competitive premiums is important. Let us cover your assets in the event of an accident or emergency. No matter what type of insurance you are looking for, look to Banas & Fickert Insurance Agency for the best in insurance coverage. Call us today at 413-527-2700 for quotes or questions. Trust in us to help keep you safe and protected.