Homeowners insurance is one of the most important financial safety nets you can have—but it’s also one of the most misunderstood. Many homeowners assume that their policy covers everything, only to be caught off guard when a claim is denied due to fine print or exclusions they didn’t know existed.

In this guide, we’ll break down what homeowners insurance typically covers, what it often doesn’t cover, and how you can ensure your policy is giving you the protection you need.

What’s Typically Covered by Homeowners Insurance?

Standard homeowners insurance policies, known as HO-3 policies, include coverage in several main areas:

1. Dwelling Coverage

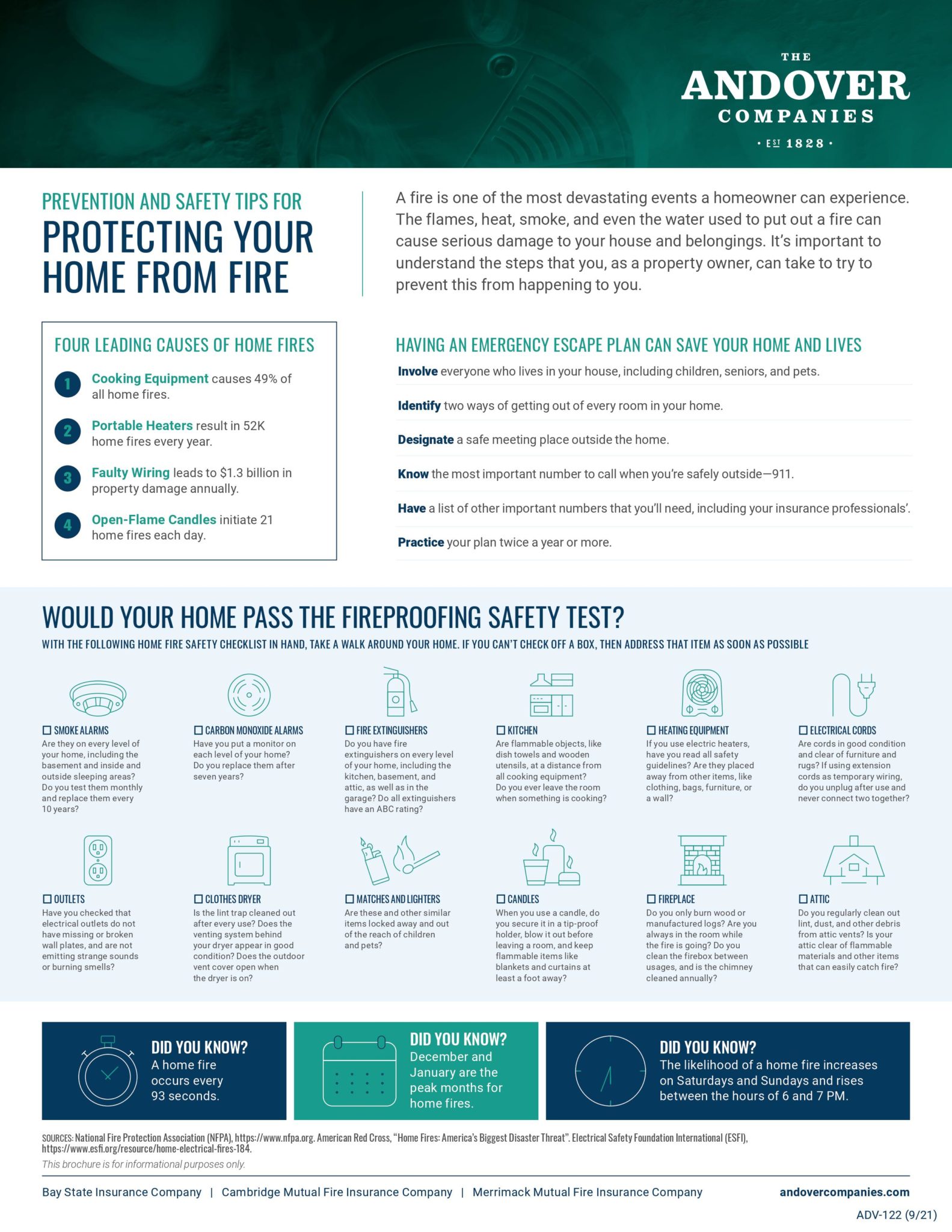

This covers damage to the physical structure of your home, including the roof, walls, floors, and built-in appliances. If your home is damaged by a covered peril like fire, lightning, hail, or a windstorm, your insurance will pay to repair or rebuild it.

2. Other Structures

Structures not attached to your home—like a garage, fence, or shed—are usually covered up to 10% of your dwelling limit.

3. Personal Property

This protects your belongings—furniture, electronics, clothing, etc.—if they are stolen or damaged by a covered event. Be aware: high-value items like jewelry or fine art may have sub-limits.

4. Loss of Use (Additional Living Expenses)

If your home becomes uninhabitable due to a covered loss, your insurance may pay for temporary housing, food, and other related costs.

5. Personal Liability

If someone is injured on your property or you cause damage to someone else’s property, liability coverage can help pay for legal fees, settlements, and medical costs.

6. Medical Payments to Others

This provides no-fault coverage for minor injuries to guests on your property, typically up to $1,000 to $5,000.

What Homeowners Insurance Doesn’t Cover

While standard policies are fairly comprehensive, they don’t cover everything. Common exclusions include:

1. Flooding

Flood damage from rising water or storm surges is not covered. You’ll need a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a private insurer.

2. Earthquakes and Sinkholes

Most policies exclude damage from earthquakes or sinkholes. Coverage must be purchased separately, especially in high-risk areas like California or parts of Florida.

3. Sewer Backups

Water damage from sewer or sump pump backups is typically not covered unless you purchase an endorsement.

4. Normal Wear and Tear

Insurance covers sudden and accidental damage—not routine maintenance issues like an aging roof or worn plumbing.

5. Termite and Pest Damage

Insect or rodent infestations are considered preventable through regular maintenance and are therefore excluded.

6. Mold (in some cases)

Mold damage caused by neglect or long-term leaks may not be covered. However, if mold is the result of a covered peril (like a burst pipe), it may be eligible for a limited payout.

Optional Add-Ons and Endorsements

Depending on where you live and what assets you want to protect, you may want to consider adding:

-

Flood Insurance

Essential in flood-prone areas. Even low-risk zones are seeing more flooding due to climate change. -

Earthquake Coverage

Required for peace of mind in seismic zones. -

Sewer and Drain Backup Coverage

Covers water damage from plumbing issues. -

Scheduled Personal Property Endorsements

Increases coverage limits for expensive items like engagement rings, antiques, or art. -

Ordinance or Law Coverage

Helps pay for rebuilding your home up to current codes after a loss.

How to Review Your Policy for Gaps

A homeowners insurance policy isn’t one-size-fits-all. Here’s how to evaluate whether yours fits your actual needs:

* Know Your Coverage Limits

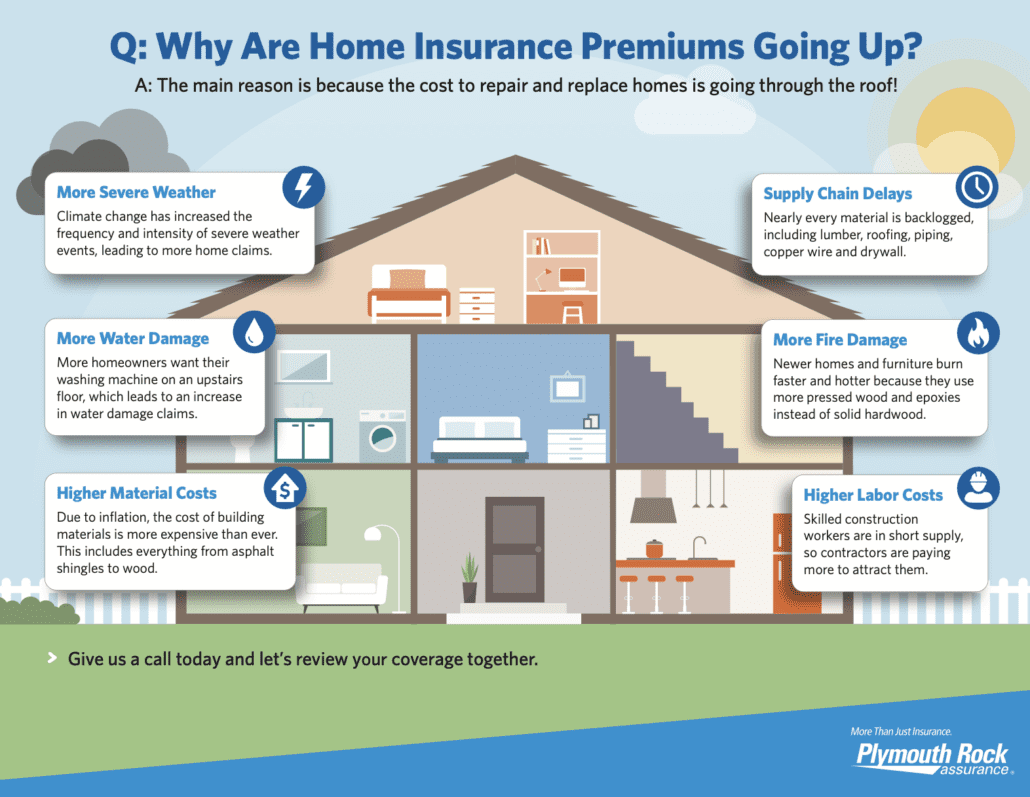

Does your dwelling coverage match the current rebuilding cost of your home—not just its market value? Have construction costs gone up in your area? If so, you might be underinsured.

* Review Your Deductibles

Some policies have different deductibles for wind/hurricane damage or hail. Make sure you understand what you’ll be responsible for out-of-pocket in different scenarios.

* Take Inventory of Your Belongings

Make a home inventory with photos and estimated values. This helps you ensure your personal property limits are adequate—and speeds up claims if disaster strikes.

* Ask About Replacement Cost vs. Actual Cash Value

Replacement cost pays to replace items at today’s prices. Actual cash value takes depreciation into account. Many policies default to the latter unless you opt in to replacement cost coverage.

Real-Life Claim Scenarios

Let’s look at two examples that show how coverage—or lack thereof—can impact a claim:

🔹 Scenario 1: Covered Loss

A tree falls on your roof during a storm, causing water damage inside. Your homeowners policy covers tree removal, roof repairs, and damage to your ceiling and furniture. You’re also reimbursed for hotel costs while your home is being repaired.

🔹 Scenario 2: Denied Claim

Your basement floods after heavy rainfall. Since you didn’t purchase flood insurance or sewer backup coverage, the damage is not covered. You’re left to pay thousands in repairs out-of-pocket.

Homeowners insurance can be a financial lifesaver—but only if you understand what’s actually covered. The key is to:

-

Read your policy carefully (or have your agent walk you through it),

-

Know what’s excluded,

-

And make sure you have the right endorsements in place for your home, location, and lifestyle.

Disasters don’t wait for you to be prepared. Take the time now to review your policy and ensure you’re protected—before you need to file a claim.

Schedule an annual insurance review with your agent. Life changes—like remodeling your kitchen or buying new electronics—can leave you underinsured if you don’t update your policy accordingly.

Having proper insurance and competitive premiums is important. Let us cover your assets and be prepared for anything. No matter what type of insurance you are looking for, look to Banas & Fickert Insurance Agency for the best in insurance coverage. Call us today at 413-527-2700 for quotes or questions. Trust in us to help keep you safe and protected